Two years ago, LGC took a powerful step in transforming our company culture. In 2022, CEO George Lessmeister and co-founder Glen Greenawalt launched the Employee Stock Ownership Plan (ESOP) as a meaningful new benefit for LGC’s employees. They recognized a key opportunity to improve employee retention, loyalty, and motivation by fostering a true sense of ownership across the company.

Designed to address challenges in an industry known for high turnover, the ESOP was introduced just before LGC’s 20th anniversary as a way to strengthen our team’s commitment to our mission.

Reflecting on the ESOP, CEO George Lessmeister noted:

“We continue to hear stories from business owners who are struggling with culture and a desire to empower their employees to feel like owners. As my co-founder Glen and I continued to talk about this challenge, we decided to motivate our employees by giving them a percentage of ownership.”

This month, we’re revisiting the ESOP program, gaining insights from our “Coffee Break” discussions, and underscoring the value of preparing for retirement. In this interview, Corporate Controller Shawnda Trout shares more on the ESOP program, its benefits, and why starting early with retirement savings can make a difference.

Q: What is the ESOP and how does it work?

The ESOP is a retirement benefit we offer at LGC where you don’t have to contribute any of your own funds to the program. What makes it unique is that by simply coming to work everyday and doing your job, you can participate in the plan.

Q: Who is eligible for the program?

All employees are eligible for the ESOP program. Our internal employees as well as our temporary employees are eligible as long as they work the 1000 hours and stay employed past the 12 month mark. So, we feel that’s a unique opportunity for temporary employees to be a part of something bigger than simply working their shift.

Q: How is the ESOP different from a 401K?

With a 401K, you would be contributing your own money and typically employers match those funds to a certain degree whether it’s 25%, 50% or dollar for dollar but you’re contributing your own funds. One of the key differences is that those funds or the account that they’re building up in that 401K is invested in companies outside of the company you’re working for. Whether it’s the stock market or mutual funds, that money is put into other investments; whereas with the ESOP, the funds are invested directly into LGC. You are earning ownership shares in LGC , so the work you do everyday is affecting how those funds grow.

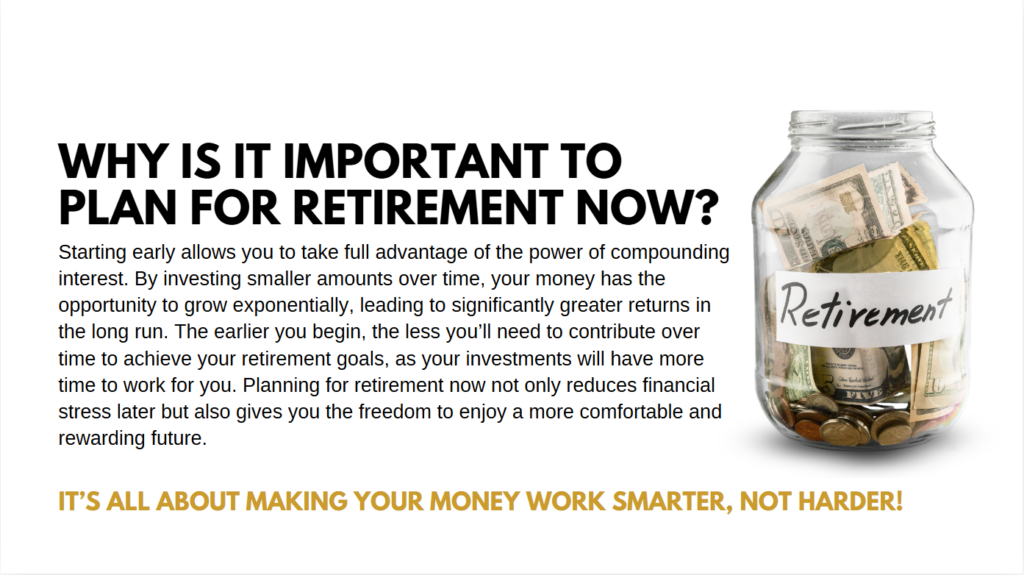

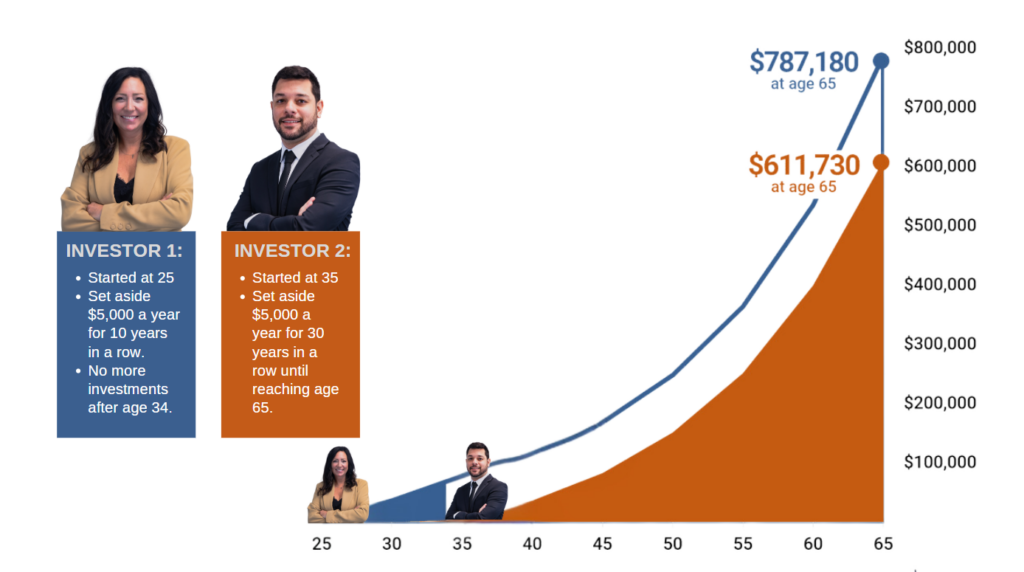

Q: Why is it important to start saving for retirement as soon as possible?

It’s always better to start early. The earlier you start, the more time you’re giving your investments to grow and gain. Even if it’s a small amount, always start early.

Q: Why do you think offering the ability to save for retirement is important to the culture of LGC?

Glen and George have always been big advocates of the American Dream, starting from the bottom, working your way up and becoming successful. I think that’s one reason they decided to offer this perk to our employees because they want everyone to feel a part of the LGC family and a part of what this company has grown to be in the past 20 years. I think the more that people feel they can play a part in the success of LGC and see that play out in their personal wealth as they grow and reach retirement age, I think that’s a great benefit that a lot of other companies don’t offer.

Q: Do you have any general tips for saving money?

- No amount is too small, just start saving

- Create a budget or an emergency fund to leave room for unexpected expenses

- Set up direct deposit when putting money into savings accounts. That’s the easiest way for me to do it. If I don’t even see the money, it’s a bit easier to put it away

- When you get a promotion, this is a little trick someone told me, since you’re not used to the extra money anyways, save ½ of it for yourself and ½ of it for your savings.

Whether you’re setting aside a small amount or planning big, every little bit helps when it comes to saving for retirement. At LGC, the ESOP provides employees a unique way to grow their savings through ownership without having to contribute their own funds. For those who dream of the future, the ESOP can be the foundation that builds toward those goals.

While the ESOP is an excellent benefit, we also encourage employees to diversify their savings strategies. Many of our team members choose additional savings options like Acorns, Nerd Wallet, Roth IRA, or SoFi. The key takeaway? Start saving now in a way that works for you, so that when retirement comes, you’ll be ready.

For more time and money saving tips, follow us on our social media channels!

In other news…

About LGC

Since 2003 LGC has been building connections between businesses with staffing needs and job seekers looking for new opportunities. Our range of solutions includes temporary and permanent placements (and everything in between) for a variety of industries. With offices located nationwide, we can tap into a dynamic pool of talented professionals. We have a passion for creating partnerships that last and work hard every day to ensure both clients and candidates reach their employment goals.