No business wants to face unnecessary costs or risk damage to its reputation. A quick fix and a lower rate might sound appealing initially, but what happens when the savings you counted on turn into millions of dollars in back wages and legal penalties? Is your business prepared to shoulder the consequences of worker misclassification?

If you’re working with a staffing company that uses independent contractors, your business could still be at risk of significant legal and financial liability. How can you tell if you’re on safe ground or headed toward hot water? Let’s examine what it really means to engage with independent contractors and how misclassification can impact your organization.

The Truth About Independent Contractors

With the use of staffing app platforms becoming increasingly common, the issue of worker classification has arisen as a hot button issue, finding its way into courts across the country. Staffing companies often assert that their workers are independent contractors, but are found guilty of violating the terms of the Fair Labor Standards Act (FLSA)(1938) on multiple accounts. Thus, their workers have been denied the pay, benefits, and practices of an employee.

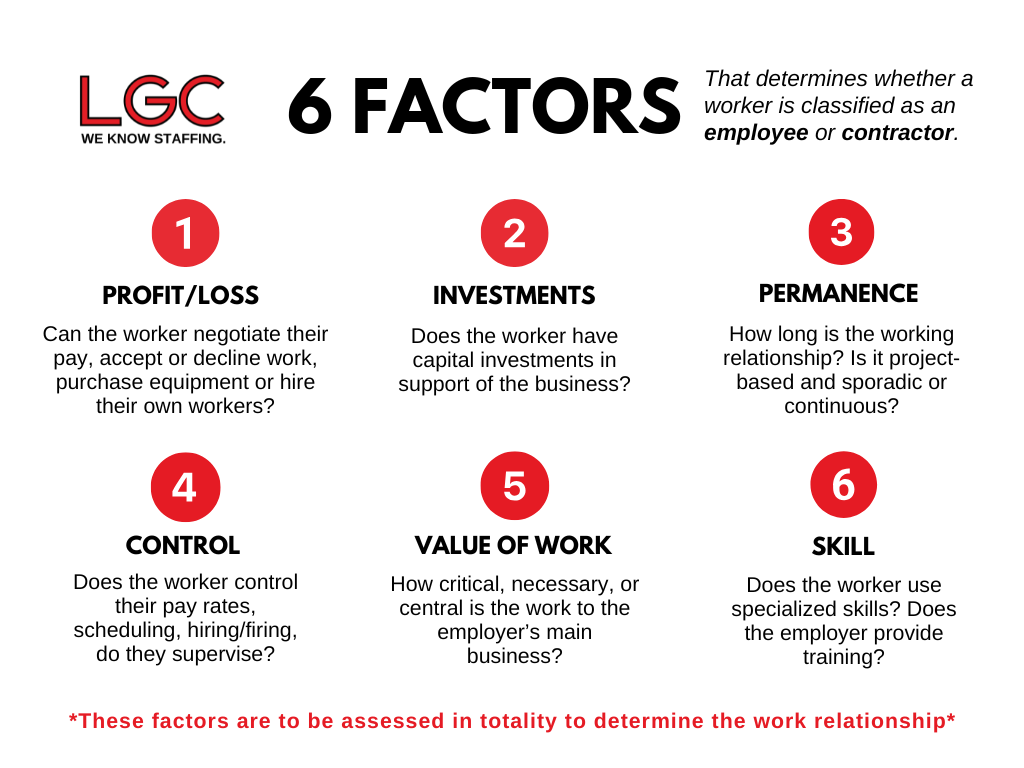

So what’s the true difference between an employee and an independent contractor? The IRS defines an independent contractor as:

“An individual is an independent contractor if the person for whom the services are performed has the right to control or direct only the result of the work, not the means or methods of accomplishing it. If you are an independent contractor, then you are self-employed.”

Consider a scenario where you are the hiring manager at a local hospital who has been struggling with maintaining a consistent number of cafeteria staff. Between a staffing firm who charges a higher rate for their W-2 employees and one that offers a cheaper alternative using independent contractors, you decide to cut costs and partner with the latter.

When we take a look at these workers, they have no ownership stake in a business, no control over how tasks are completed, and do not provide specialized skills independently. According to IRS guidelines, they are not in business for themselves and should be classified as employees. But what happens to your business if the staffing company incorrectly classifies them as independent contractors?

The consequences are costly.

A Costly Look Into Terms Agreements

In 2022, the Department of Labor found a Virginia-based staffing agency liable for misclassifying over 1,000 workers as independent contractors, resulting in a judgment of over $7.2 million in back wages and damages. In another case, a staffing company had to pay $9.3 million for similar misclassification violations.

We’re not just talking about a few hundred dollars—millions can be at stake for one decision. But how do you know if you’re exposed to liability?

Take this excerpt from a staffing app platform client contract.

“Customer [client] agrees to indemnify, hold harmless and defend [staffing company] from any and all claims arising out of or related to a Services Engagement, including but not limited to claims that Contractor was misclassified as an independent contractor, any liabilities arising from a determination by a court, arbitrator, government agency or other body that Contractor was misclassified (including, but not limited to, taxes, penalties, interest and attorney’s fees), any claim that [staffing company] was an employer or joint employer of a Contractor, as well as claims under any employment-related laws, such as those relating to employment termination, employment discrimination, harassment or retaliation, as well as any claims for overtime pay, sick leave, holiday or vacation pay, retirement benefits, worker’s compensation benefits, unemployment benefits, or any other employee benefits.”

In this example, the company names you as the sole employer of the worker. Such language is notable because if paychecks are issued by the app company instead of directly from your business, you may lack control over whether income tax, payroll, and other mandatory withholdings are accurately handled. Due to this distinction, you could become liable for:

- Unpaid wages, including failure to meet minimum wage and overtime requirements

- State and federal payroll taxes, as well as Social Security and Medicare contributions

- Civil fines, criminal penalties, and potential debarment for non-compliance with correctly distributed I-9 documents

- Lawsuits due to lack of benefits like workers’ compensation and insurance

Additionally, due to the demographics in certain staffing arrangements, you could face Equal Employment Opportunity (EEO) violations. While this may not be a guaranteed risk, it adds yet another layer of potential liability.

Why Terms and Conditions Documents Won’t Fully Protect You

Staffing app companies often attempt to use their terms agreements to avoid liability, citing strict arbitration clauses and relinquishing all responsibility to both workers and clients. However, federal and district courts have ruled that the Department of Labor and the Office of the Solicitor maintain the authority to intervene in misclassification cases, regardless of arbitration clauses.

Companies with strict arbitration agreements and limitations of liability sections that distance themselves from blame have still been required to pay millions in back wages, damages, and penalties for Fair Labor Standards Act (FLSA) violations.

In other words, a terms agreement will not save the app company and it won’t save you if you sign off on it.

The Bottom Line: Protect Your Business and Your Reputation

The bottom line is, working with staffing companies that misclassify workers isn’t just an expensive mistake—it’s a risk to your company’s financial stability, legal standing, and reputation. Beyond the potential for fines and legal liabilities, there’s also a question of trust and responsibility.

By choosing a staffing partner that properly classifies workers, prioritizes fair treatment, and ensures tax and labor compliance, you not only safeguard your operations but also build a stronger, more resilient reputation. So, protect your business on all fronts and ensure that every partner in your workforce strategy upholds the standards that reflect the integrity of your brand.

In other news…

About LGC

Since 2003 LGC has been building connections between businesses with staffing needs and job seekers looking for new opportunities. Our range of solutions includes temporary and permanent placements (and everything in between) for a variety of industries. With offices located nationwide, we can tap into a dynamic pool of talented professionals. We have a passion for creating partnerships that last and work hard every day to ensure both clients and candidates reach their employment goals.