Back in January, The U.S. Department of Labor announced its “Final Rule” for determining if a worker is an independent contractor or an employee. This rule aims to combat the issue of misclassification, which can have serious consequences for companies and employees. The rule went into effect on March 11, 2024, so let’s break it down together.

What is the “Final Rule”?

An “independent contractor” is someone who is managed by the end result, not what it took to get there. Independent contractors are then classified as a 1099 workers, which refers to their tax form, and generally do not receive benefits, workers compensation, or overtime pay. Employees on the other hand, receive a W-2 form that outlines their pay, and the benefits they receive. Companies are required to provide these benefits for employees only, so the problem is that some employees are wrongfully misclassified as independent contractors and therefore not given the benefits or pay they deserve.

According to a 2020 study done by the National Employment Law Project, an estimated 10-30% of employers misclassify their workers as independent contractors. Misclassifying an employee as an independent contractor removes the security of minimum wage, overtime pay, protection from discrimination, and other benefits. It is also costly for the companies due to fees by the IRS when it is discovered. So, the Department of Labor’s new rule attempts to confront this issue by making it significantly harder to classify a worker as an independent contractor.

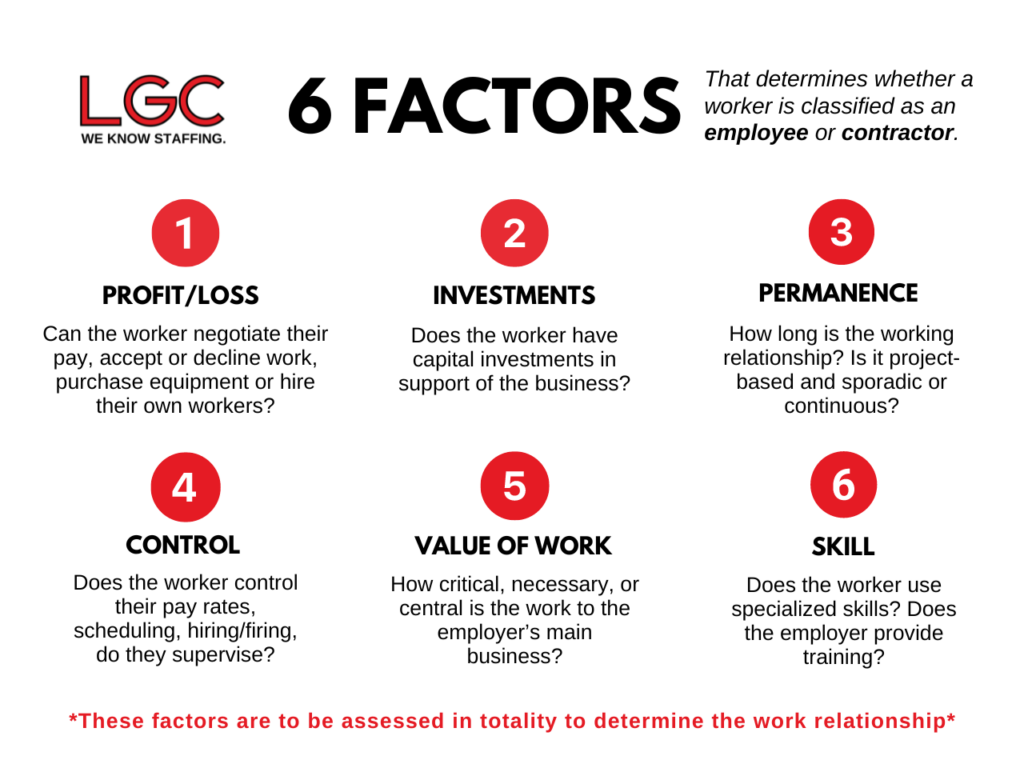

The rule addresses 6 factors that employers will have to take into consideration at the beginning of a working relationship. An “economic realities” test will be used to decide whether the worker is an independent contractor or an employee. Essentially, this “test” outlines the degree of dependence the worker has on the employer. If they are more dependent on the employer they will qualify as an employee and if they are in business for themselves, they are an independent worker.

Impact on Temporary Work

Temporary employment will see some of the most impact. This is exciting news because it will give misclassified independent contractors the rights they deserve as employees.

This rule protects both employers and employees. For example, if someone is hurt on the job, there is less risk of liability due to workers compensation being in place. Additionally, if you’re working overtime but are an independent worker, you won’t get paid for that overtime. With this new rule, that work would be considered employee level and therefore you will be paid overtime. The good news is, for us here at LGC, this has always been the case.

LGC is a W-2 Industry Leader

When LGC started, we made the decision to classify all of our workers as employees and provide benefits no matter the type of employment (temporary or permanent). This legislation only changes things for companies that do not make the correct classification of their workers. So, employers and job seekers, here are the considerations we recommend:

Employers

Our biggest piece of advice for employers is to check with your staffing firm to make sure they are upholding the protections for you and your employees. At LGC, we W-2 all of our employees so that they receive overtime pay, insurance, workers compensation and more. You can trust that we protect you and your employees so that you can focus on your business.

Job Seekers

For job seekers, our piece of advice is to make sure the staffing firm or company you are working with will uphold the Final Rule. It is there for you and them. At LGC, you never have to worry about not receiving pay, benefits, or support. You can trust that we will make sure you are covered so you can work when and how you want.