On April 23, 2024, the Department of Labor issued another final rule that will increase compensation thresholds for salaried workers who are ineligible for overtime pay. This rule, going into effect in two parts, will raise the payment expectations for these workers by over $23,000 annually.

As a hospitality staffing company, we recognize the keen impact this rule will have on the food service industry and related sectors. As a result, we want to offer clarity on what this rule entails, its impact on your business, and how we can offer support in navigating these changes.

The Department of Labor’s Final Rule for Salary Thresholds Explained

The 3 major components to the rule include:

1. Increased salary for “white collar” employees

The term “white collar” employees refer to those who are usually in managerial or administrative roles. They usually work in an office and are at least an arm’s length away from manual labor. These are positions such as hotel and restaurant managers and executive chef positions due to their specialized skills.

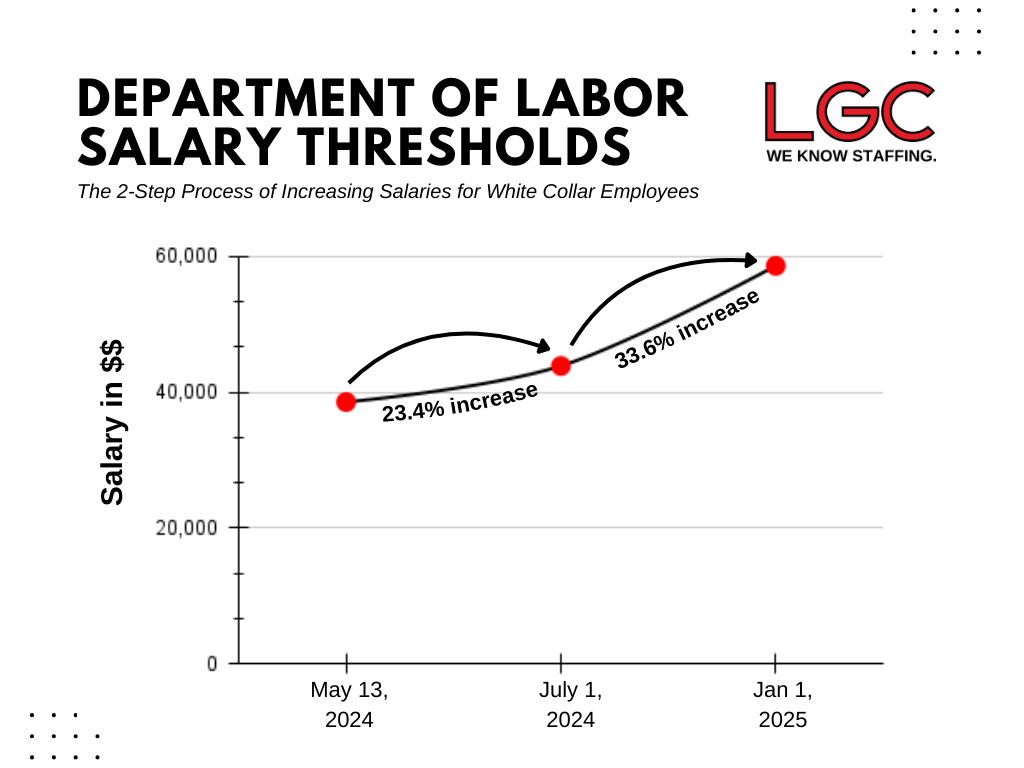

The final rule increases the current salaried threshold from $35,568/year ($684/week) to $43,888/year ($844/week) by July 1st and then $58,656/year ($1,128/week) by January 1, 2025. The increase in salary aims to compensate for the overtime hours that they often end up working but are ineligible to be paid for as they are salaried employees.

2. Increased total annual compensation for bona fide highly compensated employees:

Highly compensated employees must meet one of two qualifications: 1) they must own at least 5% of the business during the current or previous year, and/or 2) their compensation must be above $150,000 in 2023 and be in the top 20% of the company’s pay.

With the final rule, the total annual salary for bona fide highly compensated employees will increase from $107,432/year to $132,964/year by July 1st and then to $151,164/year by January 1, 2025.

3. Automatic updating every 3 years:

Due to the ever-changing job market and economic outlook, this rule also implements an automatic update or reconsideration every 3 years to reflect changes in earnings.

What does this mean for businesses?

For small businesses, labor costs are a large part of their budget. With the increase, this means many businesses will have to reclassify their salaried workers as hourly employees. Due to these thresholds being calculated by national averages instead of regional, urban establishments will be able to make the transition more smoothly, but those in rural areas may not be able to keep up. Additionally, out West, where the minimum wage requirements are significantly higher, the impact will not be as instrumental as those in the Midwest and South.

“Because [the] DOL created a one-size-fits all rule based on national income data, rather than regional data, this change is going to disproportionately impact restaurant owners in the South and Midwest.” – Sean Kennedy, Executive VP of Public Affairs, National Restaurant Association

Another point of concern for small businesses is lack of access to departments that could help implement these changes. Without operating legal or human resources departments, many establishments may not have the resources to support them in transitioning into this new rule. Whether it be helping them understand the legal implications, assessing which employees need to be reclassified, or going through the process of redistributing benefit packages, this rule has serious implications for small businesses that may not be able to adapt by themselves.

How should you prepare?

So, how should you get your business ready to meet the expectations of this final rule? First, you need to evaluate your means.

Can you financially meet the increased salary requirements for your salaried employees? If not, will you switch them to hourly compensation? How will that transition affect your current schedules? Will you have to reduce other employees’ hours to make up for the switch? Have you familiarized yourself and management with effectively implementing these changes?

If you can’t handle the switch financially, have you considered other options? Maybe it’s time to consider working with a staffing firm. We understand the value of retaining your skilled, salaried employees. Rather than exceeding the 40-hour workweek, let us handle the coverage for any overtime hours they may be working. You can relax knowing that we’ll manage the screening, recruitment, hiring, and more, ensuring a seamless process for your staffing needs. One of the greatest benefits of partnering with a staffing firm like LGC is having an extra set of hands, literally.

You’ll get more help in the kitchen, or wherever you need it, and we’ll handle all aspects of their employment, including payroll, workers’ compensation, and addressing any issues that may arise. It’s a win-win, you don’t have to pay the time and half for your salaried workers, and you won’t be understaffed either.

As this rule will unintentionally target the foodservice industry, we are equipped with the knowledge and expertise to understand the needs of this industry. As a hospitality focused firm, we want to help you make this transition so that you can keep your talented workers and not have to make a costly shift.

The bottom line is, as a business you need to have a plan in place. We would love to be a part of your plan to help make the transition as smooth as possible. If you need help, give us a call and we’ll have your back.

Read about the Department of Labor’s other rulings here:

Stay up to date with all things LGC on our socials!

About LGC

Since 2003 LGC has been building connections between businesses with staffing needs and job seekers looking for new opportunities. Our range of solutions includes temporary and permanent placements (and everything in between) for a variety of industries. With offices located nationwide, we can tap into a dynamic pool of talented professionals. We have a passion for creating partnerships that last and work hard every day to ensure both clients and candidates reach their employment goals.